Key Investor Relations Trends For 2020

The role played by Investor Relations has been quickly evolving, whether due to changes in regulation, new technologies or the dynamics of an unpredictable market. Having control over these transformations is fundamental for success. To help keep you informed and, perhaps, even contribute with your annual planning, we constructed a list of key investor relations trends for 2020:

To access the full document, click here.

1. COMMUNICATION WITH INDIVIDUAL INVESTORS

Due to new technologies and its facilities, there has been an increase in retail investors entering the stock market. Therefore, companies now face the challenge of adapting their communication style in order to meet the demands of this growing audience.

In order to attract this new type of investor, IR professionals need to take steps beyond the traditional approach aimed at retail investors, which includes invitations to events, access to management and an open communication channel with the IR department.

Retail investors have more dynamic profiles and seek –operating and financial data in a more digital and direct manner. They appreciate interactive solutions, such as videos, podcasts, social networks and intensive use of technological tools.

Thus, IR professionals need to establish a multichannel approach that ensures that the company’s message is being well understood by all investors.

2. METRICS THAT HELP MEASURE THE EFFECTIVENESS OF THE IR PROGRAM

Measuring the efforts carried out by IR professionals has never been an easy task since data is rarely integrated. By analyzing share prices alone, we ignore issues that go beyond the work carried out by IR, thus compromising the result of the assessment. Additionally, the number of meetings or conferences held in the period does not necessarily imply they were effective. The challenge for Investor Relations Officers is to gain exposure to C-Level and Board executives in order to present the efforts carried out by the IR team aimed at:

- Reducing cost of capital;

- Generating value by raising the ratio between share price upside and financial multiples (always in relation to the company’s peers);

- Managing the company’s shareholder based in such a way that it is in line with the company’s current investment strategy and thesis;

- Mastering relationships with analysts to reduce dispersion between estimates;

- Measuring the conversion rate of prospect investors (targets) into actual shareholders as a result of meetings and conferences, thus improving the use of management’s time (productivity);

- Receiving feedback from the market on its perception regarding the company’s positioning and strategy against its peers and/or comparable players;

- Monitoring the company’s compliance with regulatory bodies;

- Articulating the company’s value proposition: create an investment thesis based on premises and facts that clearly expose the company’s strategic choices and how it effectively creates value through consistent and sustainable growth.

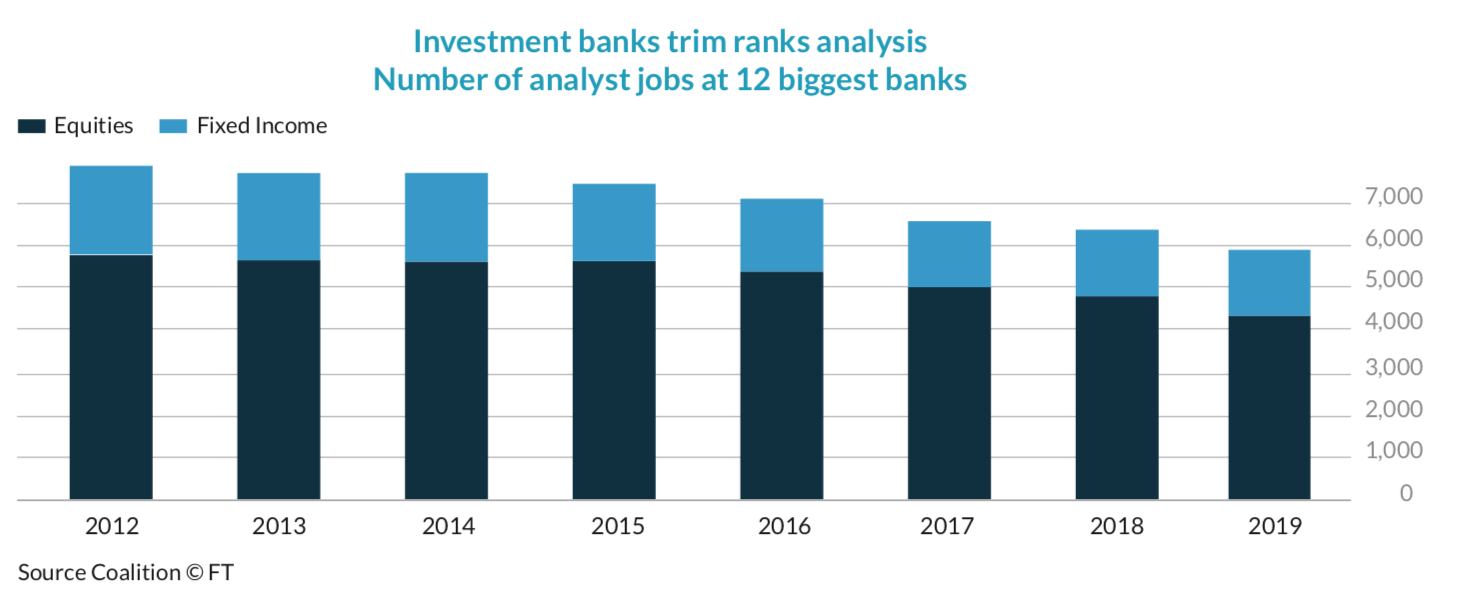

3. CHALLENGES ARISING FROM THE MIFID II FRAMEWORK AND IMPACTS ON CORPORATE ACCESS

According to Bloomberg, the number of sell-side analysts declined 8% in 2019. Budgets for research analysts are expected to be reduced by 20% to 30% in 2020.

The MIFID II framework brings new challenges to IR teams, mainly in terms of access to institutional investors, portfolio managers and buy-side analysts, which is done directly and without intermediation by brokers/investment banks.

Many institutional investors have established their own internal corporate access teams to help facilitate meetings between the corporate issuers and their own portfolio managers and decision makers.

Companies that have lost significant research coverage must have a more proactive IR approach. The importance of the IR website along with the format and quality of the communication materials are now more important than ever. IR professionals must also be able to more effectively identify and track investors – that is, understand who is accessing the website and what they are searching for. Cross-referencing mailing and webcast analytics with the company’s shareholder base and targeting strategy is also fundamental.

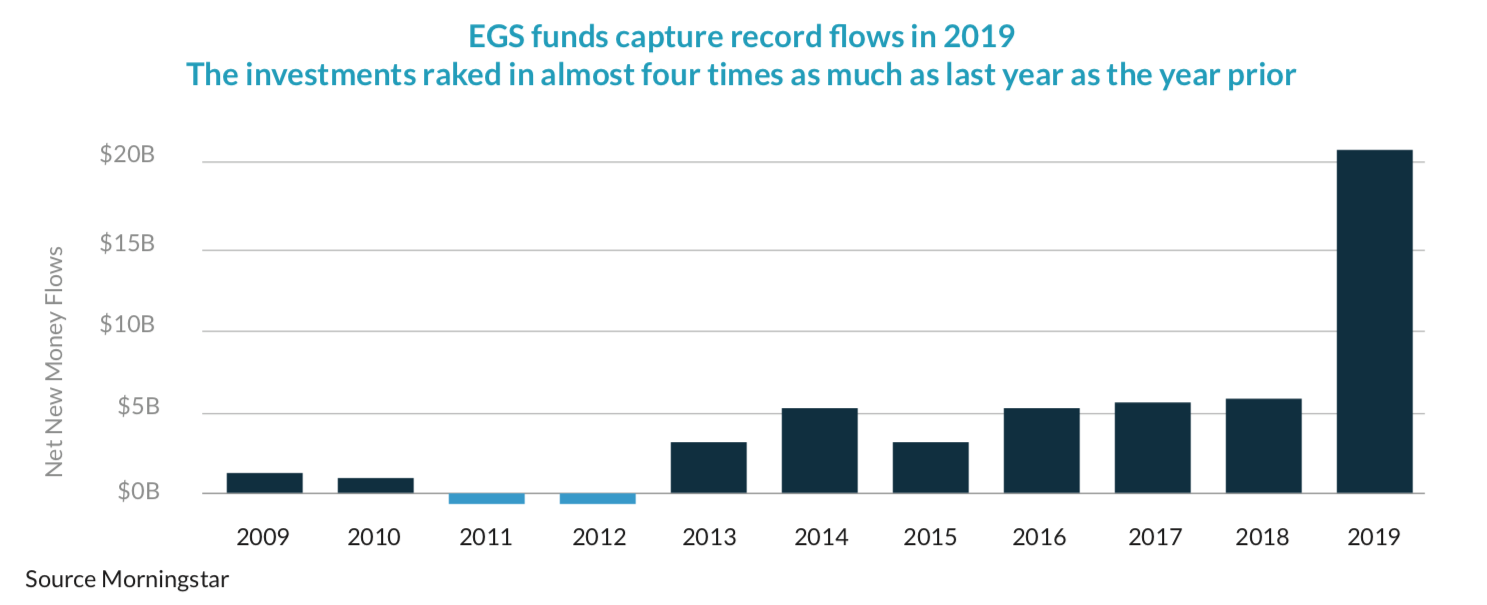

4. ADOPTING STANDARDS TO REPORT ESG FACTORS

Investors are increasingly expecting that IR teams understand Environmental, Social and Corporate Governance issues and include data on these matters in the company’s releases, websites and other communication materials. ESG has already been discussed for years but is gaining more relevance. Some companies already include ESG tables applicable to their respective industries and in accordance with the standards established by the Sustainability Accounting Standards Board.

Forbes magazine estimates that 1⁄4 of all global AUM already analyze ESG data, which means that IR professionals must be prepared to answer questions during one-on-one meetings, increase ESG data on IR websites and deeply understand how ESG can help mitigate corporate risks.

5. AUTOMATION OF PROCESSES THAT IMPROVE TIME MANAGEMENT

IR professionals are being pressured to deliver new ESG data, disseminate this information in a way that it reaches retail investors, take active roles in the search for new investors within the scope of the new MIFID II legislation, and maintain a lean and efficient team. None of this is possible without the use of new technologies that help reduce the time spent on operational activities and allow a more targeted work approach.

To achieve this, key resources available include:

- Virtual roadshow platforms

- Pre-recorded videos for disclosing results

- IR websites with automatic updating of CVM and SEC files

- Single-click mailing system

- CRM fueled with market data

- Targeting intelligence tools

- The use of technology that generates reports and analyses the shareholder base, as well as integration with other day-to-day tools.

6. STRATEGIC COMMUNICATION CHANNEL: MARKET FOR THE COMPANY

Although the primary role of the IR department is to communicate with investors, being able to convert one-way conversations into dialogues is where the true strategic value lies.

Investor feedback is valuable for the Company’s managers and provides a direct answer to how the company is perceived by the market. By providing details on investor concerns, IR teams can help the Board of Directors to gain a better sense of how the company’s strategy is being perceived (planning and execution), allowing for adjustments along the way that ensure long-term success and keep investors satisfied in the short term.

7. APPLICATION OF THE GENERAL DATA PROTECTION REGULATION (GDPR)

The European Union’s Global Data Protection Regulation (GDPR) came into effect on May 25, 2018 and governs the acquiring, processing and storage of personal data of current and former EU residents. The California Consumer Privacy Act (CCPA) came into effect on January 1, 2020 and governs how companies process data for individuals living in California.

All of these regulations aim to protect individual rights. For IR teams, this implies in having candid conversations with their service providers on how they are processing data and what storage methods are used, especially regarding information on security and data confidentiality at the source where information was collected:

- Use of cookies in IR websites;

- Registration data on platforms that require login and password;

- Data obtained from the Webcast access form;

- Data obtained from the Mailing registration form;

- Data obtained from the Contact IR form;

- How shareholder data from the custodian bank’s file is controlled.